Volatility within the broader monetary sector has affected many Actual Property Funding Trusts (REITs) with many of those shares promoting off mightily over the previous couple of weeks.

Nevertheless, traders could also be in search of alternatives amongst these equities as REITs can provide profitable dividends together with useful publicity to actual property.

Listed below are 3 Zacks Rank #1 (Robust Purchase) REIT shares that traders might wish to take into account as they seem like buying and selling at a reduction.

Alexander & Baldwin Holdings (ALEX)

First up is Alexander & Baldwin Holdings which owns, operates, and manages retail, industrial, and workplace area primarily in Hawaii and on the U.S. mainland. Along with this Alexander & Baldwin additionally owns grocery/drug-anchored retail facilities.

Shares of ALEX at present commerce at $17 per share and 16.6X ahead earnings which is barely above the business common of 10.4X. Nevertheless, Alexander & Baldwin inventory trades 84% under its decade excessive of 108.3X and at a 46% low cost to the median of 31.1X.

Even higher, earnings estimate revisions have gone up over the past 30 days. Fiscal 2023 earnings estimates have gone up 6% with FY24 EPS estimates rising 10%. Alexander & Baldwin’s 5.44% dividend yield is barely above its business common and rewards traders because the broader monetary sector appears to stabilize.

Picture Supply: Zacks Funding Analysis

Arbor Realty Belief (ABR)

One other REIT traders might wish to take into account for the time being is Arbor Realty Belief, a specialised actual property finance firm that invests in actual estate-related bridge and mezzanine loans, most well-liked fairness, and mortgage-related securities amongst different actual property property.

Arbor Realty’s inventory trades round $11 per share and 5.7X ahead earnings which is barely under the business common of 6.4X. Plus, shares of ABR commerce 67% under its decade excessive of 17.5X and at a 46% low cost to the median of 10.6X.

Arbor Realty’s fiscal 2023 EPS estimates have gone up 6% over the past 30 days and are actually anticipated at $1.90 per share. This helps the inventory being undervalued from a P/E perspective. Even higher, the 14.76% dividend yield at $1.60 per share is barely above the business common and needs to be very rewarding to traders at ABR’s present ranges.

Picture Supply: Zacks Funding Analysis

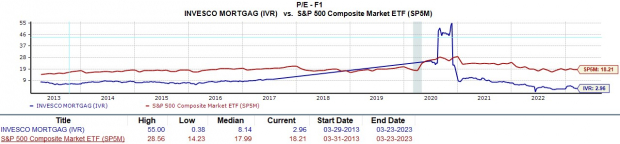

Invesco Mortgage Capital (IVR)

Rounding out the checklist is Invesco Mortgage Capital which focuses on financing and managing residential and commercial-backed securities and mortgage loans.

Invesco’s inventory stands proud at $10 per share and monetary 2023 earnings estimate revisions have soared 22% within the final month. Earnings are actually anticipated to be at $3.54 per share in FY23 in comparison with estimates of $2.89 thirty days in the past.

This actually makes shares of IVR look undervalued buying and selling at simply 2.9X ahead earnings and properly under the business common of 6.4X. Moreover, Invesco inventory trades 96% under its decade-long excessive of 55X and 63% beneath the median of 8.1X.

On high of that, IVR’s dividend yield is a really interesting 24.81% for the time being and nicely above an already excessive business common of 13.62%.

Picture Supply: Zacks Funding Analysis

Takeaway

These three REITs are numerous of their choices and seem like undervalued at their present ranges with the rising earnings estimate revisions supporting this. Extra upside might actually be within the playing cards for these shares when volatility within the broader monetary sector subsidies and their stellar dividend yields give traders one more reason to purchase.

4 Oil Shares with Large Upsides

World demand for oil is thru the roof… and oil producers are struggling to maintain up. So regardless that oil costs are nicely off their current highs, you possibly can count on huge earnings from the businesses that provide the world with “black gold.”

Zacks Funding Analysis has simply launched an pressing particular report that will help you financial institution on this development.

In Oil Market on Fireplace, you will uncover 4 sudden oil and fuel shares positioned for large positive aspects within the coming weeks and months. You do not wish to miss these suggestions.

Download your free report now to see them.

INVESCO MORTGAGE CAPITAL INC (IVR) : Free Stock Analysis Report

Alexander & Baldwin Holdings, Inc. (ALEX) : Free Stock Analysis Report

Arbor Realty Trust (ABR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.