By BCM Funding Workforce

Good Portfolios For Difficult Instances

Overview

What began as a summer time of optimism in markets ended with a fall of concern. Robust speak[1] from the Federal Reserve and August’s inflation print introduced fairness and glued revenue markets broadly in direction of new lows to shut out the quarter.

This stays an awfully difficult and unpredictable funding setting as a result of exogenous occasions (Covid/China supply-chain bottlenecks, Ukraine Struggle/Europe Vitality disaster) and the unprecedented authorities fiscal and interest-rate interventions within the financial system.

[wce_code id=192]

The probabilistic machine studying fashions which might be the muse of the Decathlon system counsel that equities are “oversold” and provide favorable risk-reward, likewise for bonds. Other than our statistical and behavioral-based quantitative programs, there may be loads of qualitative proof that buyers are very fearful and already girded for substantial additional market declines. We consider downturns are much less more likely to happen when buyers are braced for them. Subsequently, each quantitatively[2] and qualitatively, our evaluation is that it is a well timed entry level, that the precise danger is lower than the perceived danger, and that being considerably contrarian will repay.

Moreover, after the three% upward shift[3] within the yield curve this 12 months and the worst drawdowns on document for fastened revenue and conventional balanced methods, the ahead returns of a 60/40 sort portfolio are probably larger than they’ve been in a few years. Whereas the current efficiency of balanced portfolios has been irritating for all buyers, we count on balanced methods to offer enticing absolute returns in most market eventualities with much less volatility and psychological stress than lately skilled.

Our greatest concern going ahead is ongoing mismanagement of rates of interest by the Federal Reserve. The fast rate of interest will increase this 12 months has destroyed substantial wealth in each asset class world-wide that’s publicly traded. Actually, buyers of each stripe have already skilled a “laborious touchdown” that has considerably lowered their wealth and sure will scale back their near-term financial exercise. Likewise, many industries, similar to housing and semiconductor reminiscence, are already reporting year-over-year declines in enterprise exercise of 20%.[4]

Injury in markets is widespread and worse than it seems on the floor, EAFE Equities are 20% beneath their pre-pandemic highs and US Small Cap firms are flat and now commerce at a traditionally low ahead P/E of simply 10.8, an earnings yield of practically 10%[5].

It is our perception that historical past won’t look favorably upon the present Federal Reserve and their administration of the financial system by way of all phases of the pandemic. The most recent mistake is navigating by looking the rear window, making choices primarily based on stale historic info, and never listening to the real-time deterioration and worth destruction in full view as a result of excessive price hikes. The Federal Reserve members publicly proclaim that “financial coverage acts with lengthy and variable lags”, but they lack the endurance to attend for the affect of their actions.

Whereas finally the course of the financial system will decide the course of the market, we consider this can be very unlikely to happen in a straight line. We’ll proceed to search for alternatives to tactically add worth which can be of elevated significance whereas neither normal fairness nor fastened revenue publicity has but to repay for buyers.

A Deeper Dive

Inflation hasn’t cooled off quick sufficient

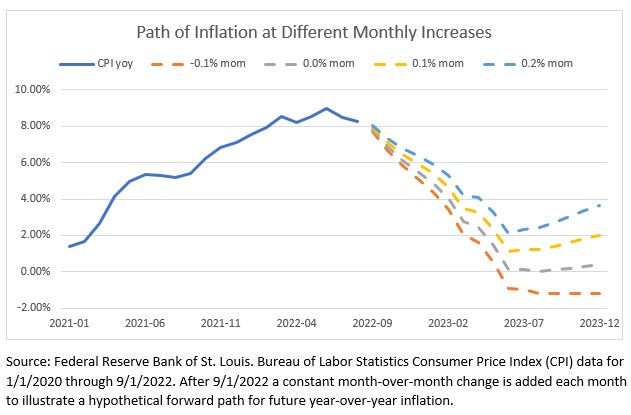

August’s Client Worth Index (CPI) report took the market unexpectedly, displaying +0.1% month-over-month rise in costs in comparison with expectations for a small lower from Bloomberg’s economist survey. Maybe extra concerningly, core inflation, which excludes the good thing about decrease oil costs, elevated 0.6%–practically double July’s improve and a 7.4% annualized price. This has economists and market members apprehensive that core CPI will act as a flooring for future inflation and necessitate a extra extreme recession than beforehand anticipated. Regardless of the doom and gloom over inflation, we keep the opinion that the U.S. financial system is previous peak inflation. The extent of costs stays comparatively unchanged since June and lots of[6] market indicators are pointing in direction of decrease inflation. The illustration beneath reveals the potential path of headline inflation if month over month modifications stay comparatively muted. Headline inflation won’t fall shortly and not using a lower in costs, however a continuation of current tendencies will deliver 12 months over 12 months inflation right down to acceptable ranges in due time.

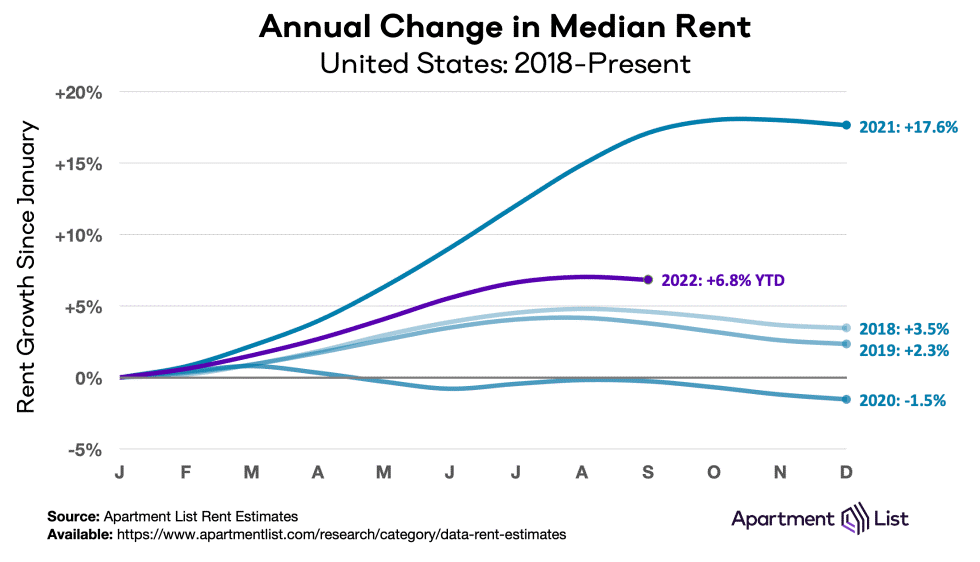

Realizing this path of decrease inflation might be largely depending on slower will increase in the price of shelter and labor. The price of shelter, which rose 0.7% in August[1], is the biggest element of core CPI and was chargeable for greater than half of August’s core CPI development. This can be a lagging indicator of true inflation, as housing turnover is required for many housing costs to re-set and housing turnover is at historic lows. As well as, a lot of sources present that each lease and residential costs have stagnated.

Whereas wages are an oblique enter to CPI, wage development is the important thing driver of the demand facet of the inflation equation, and for many of the 12 months wage development has been extraordinarily sturdy. In current months that too has flattened as staff proceed to re-join the labor pressure. This resulted in an improve in unemployment in August regardless of 315,000[1] extra staff employed within the month. If wage development and shelter prices proceed to abate it’s laborious to be overly involved about one other inflationary surge within the near-term.

Will the Federal Reserve “break the financial system?”

“We now have obtained to get inflation behind us. I want there have been a painless approach to do this. There isn’t” – Jerome Powell.

With the good thing about hindsight, the Federal Reserve is behind the ball on inflation. Current powerful rhetoric is both an try to save lots of face or an try to make use of the forward-looking nature of markets to tug ahead tighter monetary situations earlier than having to straight implement them[2].

We aren’t apt to learn into the Fed’s psychology and decide if they’re certainly bluffing or are decided to make good on their phrases, however with the federal funds price at 3-3.25%, one-year treasury yields at 3.98%,[3] and an more and more inverted yield curve it looks like the market does consider them. If markets are already discounting the Fed following by way of with their plan, any modifications might be a constructive shock.

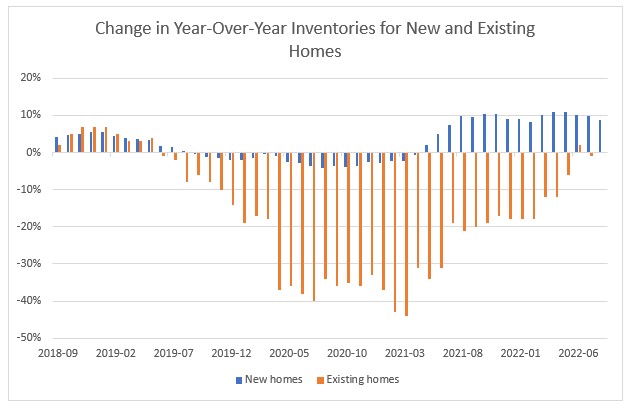

Basically it’s clear that larger rates of interest are having the supposed results. Housing is essentially the most rate of interest delicate sector within the financial system and exercise has dried up. With mortgages at 7%, in comparison with 3% earlier this 12 months, the efficient price of the identical priced home is roughly 60% larger. [4]Sellers presently seem unwilling to commerce of their low fastened price mortgages, whereas consumers have had affordability cramped. Because of this, new properties constructed by homebuilders stands out as the solely significant supply of provide within the short-term.

Supply: Bloomberg. Nationwide Affiliation of Realtors. Information from 8/31/2017 to eight/31/2022.

Finally all of it comes right down to earnings

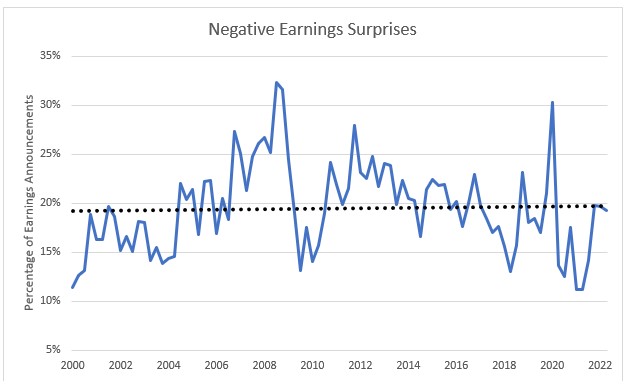

Finally macroeconomic hypothesis trickles right down to the market straight by way of company earnings. Within the second quarter we noticed some continued margin stress, probably a results of each inflation and evaluating towards excessive volumes of 2021. Nevertheless, the market was effectively calibrated for these earnings and unfavourable surprises sometimes seen round recessions have been largely absent. These comparatively sturdy earnings bolstered the markets at the start of the second quarter and might be an vital catalyst looking forward to the approaching months.

Supply: Bloomberg Earnings Shock Index. Information from 3/1/2000 to six/30/2022.

Final quarter we mentioned the surplus inventories at retailers that spooked the market—–this quarter it was Federal Specific. It could be unwise to disregard one of many main carriers providing weak steerage and volumes when forecasting a possible recession, however the FedEx steerage might additionally symbolize a continued shift of client habits each from items to providers and digital to bodily. Counter to FedEx’s weak steerage, commentary from banks and bank card firms so far implies the buyer has but to noticeably weaken.

Vitality sector reveals first indicators of its customary volatility

Even this 12 months’s lone brilliant spot in fairness markets, Vitality, has been underneath stress as a result of fears of falling demand. The S&P 500 Vitality sector fell over 25%[5] from highs in simply over a month at the start of July regardless of ending the quarter as among the best performing sectors. Spot oil costs at the moment are decrease than earlier than Russia’s invasion of Ukraine, regardless of no materials modifications in coverage in direction of Russian oil. One of the vital humbling examples of how troublesome investing may be is that by far the very best performing sector because the pre-pandemic excessive is Vitality and the worst is Communications[6], nearly a precise inverse of the basic results that occurred whereas we have been locked down.

Concluding Ideas

Making ready for the worst could make the “worst” unlikely

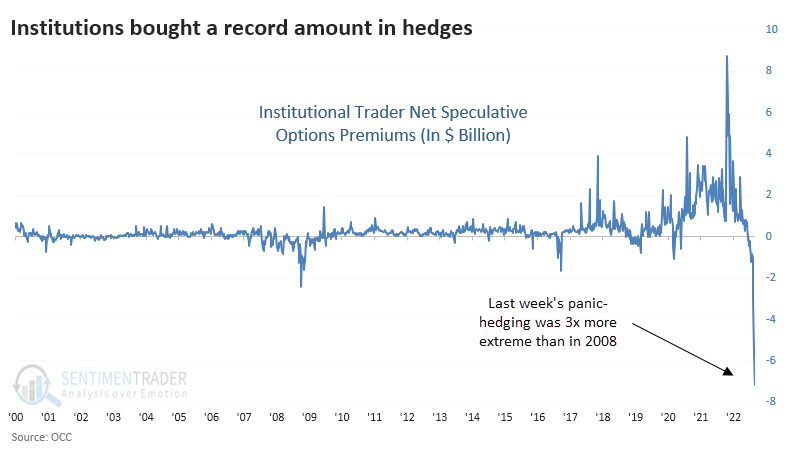

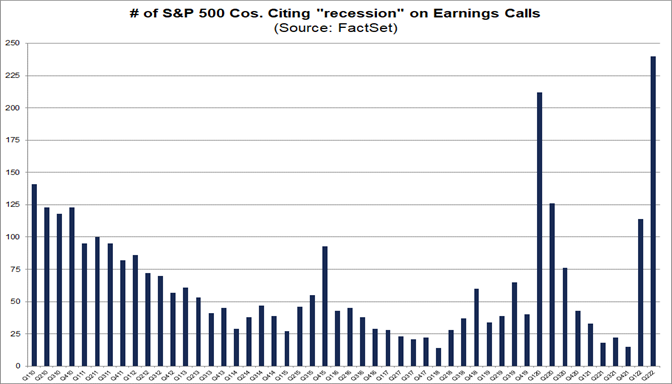

Traders seem like positioned defensively and companies have already ready for the worst. Regardless of the harm that has already occurred, cash market and financial institution deposit balances have by no means been larger in historical past[7], nor has demand for hedging by way of places. Many companies having already undertaken elevated fiscal self-discipline as they anticipate harder occasions forward.

Supply: SentimentTrader.

Supply: FactSet Analysis.

As we talked about final quarter, unhealthy debt is the true offender of deep recessions. Though rates of interest are making future debt dearer, the overwhelming majority of present debt is fastened to low charges and won’t encumber people or most companies for fairly a while. The mixed results are a market and financial system ready for the worst. On one hand this could be a self-fulfilling prophecy as weaker funding and hiring slows financial development, however on the opposite this makes essentially the most harmful state of affairs of a significant sudden decline in financial exercise much less probably. We proceed to consider this backdrop of economic well being can mitigate the harm inside the financial system, whereas buyers bearish positioning could present a horny longer-term entry level for a lot of property.

[1] https://www.bloomberg.com/information/articles/2022-08-26/powell-says-history-warns-against-prematurely-loosening-policy

[2] In comparison with each their 200-day and 50-day transferring averages, the pool of ETFs we observe is at a comparatively excessive degree. This degree was final seen on the market’s backside in June and has traditionally yielded very sturdy ahead returns on common. Since June 2000, the common 1-month ahead return for the S&P 500 at ranges this far beneath the 50-day transferring common has been over 4%.

[3] Federal Reserve Financial institution of St. Louis, Federal Funds Price from 1/1/2022 by way of 9/30/2022

[4] Micron Expertise Inc., Fourth Quarter 2022 Earnings launch

[5] The EAFE Index ETF (EFA is down 10.4% since 2/1/2020). S&P 600 P/E of 10.8 from Yardeni Analysis Inc. 9/30/2022.

[6] Along with rents and wages talked about beneath, residence costs fell in August, authorities spending has been unfavourable year-over-year for five quarters and numerous provider value indices, most lately and notably the ISM costs paid index, are effectively off their highs.

[7] US Bureau of Labor Statistics, August Client Worth Index launch.

[8]US Bureau of Labor Statistics, August unemployment launch

[9] An instance of the market implementing Federal Reserve coverage for them is in March/April of 2020 when the Federal Reserve indicated that it might purchase fastened revenue ETFs that have been buying and selling beneath NAV. This announcement brough many fastened revenue ETFs again consistent with the NAV and the Federal Reserve by no means wanted to observe by way of with precise large-scale purchases of fastened revenue ETFs.

[10] Federal Reserve Financial institution of St. Louis, 9/30/22

[11] 1/30 for amortization = 3.3% + 3% mortgage = 6.3% prior, now that very same math is 10.3%, a fee roughly 60% larger

[12] Koyfin. Information from June 6th to July 15th, 2022.

[13] Koyfin. Since 2/1/2020, the Vitality sector (XLE) has risen 57.3%, whereas the Communications sector (XLC) has fallen -10.2%.

[14] Federal Reserve Financial institution of St. Louis. Cash market funds maintain $5.032 Trillion whereas Financial institution deposits are $17.953 Trillion. These are up from $4.727 Trillion and $13.320 Trillion pre-pandemic.

Disclosures

Copyright © 2022 Beaumont Capital Administration LLC. All rights reserved. All supplies showing on this commentary are protected by copyright as a collective work or compilation underneath U.S. copyright legal guidelines and are the property of Beaumont Capital Administration. You could not copy, reproduce, publish, use, create by-product works, transmit, promote or in any approach exploit any content material, in entire or partially, on this commentary with out categorical permission from Beaumont Capital Administration.

This materials is supplied for informational functions solely and doesn’t in any sense represent a solicitation or provide for the acquisition or sale of a particular safety or different funding choices, nor does it representinvestment advicefor any individual. The fabric could include ahead or backward-looking statements concerning intent, beliefs concerning present or previous expectations. The views expressed are additionally topic to alter primarily based on market and different situations. The data introduced on this report relies on information obtained from third occasion sources. Though it’s believed to be correct, no illustration or guarantee is made as to its accuracy or completeness.

The charts and infographics contained on this weblog are sometimes primarily based on information obtained from third events and are believed to be correct. The commentary included is the opinion of the creator and topic to alter at any time. Any reference to particular securities or investments are for illustrative functions solely and usually are not supposed asinvestment advicenor are they a advice to take any motion. Particular person securities talked about could also be held in consumer accounts. Previous efficiency is not any assure of future outcomes.

As with all investments, there are related inherent dangers together with lack of principal. Inventory markets, particularly international markets, are unstable and might decline considerably in response to antagonistic issuer, political, regulatory, market, or financial developments. Sector and issue investments focus in a specific business or funding attribute, and the investments’ efficiency might rely closely on the efficiency of that business or attribute and be extra unstable than the efficiency of much less concentrated funding choices and the market as an entire. Securities of firms with smaller market capitalizations are usually extra unstable and fewer liquid than bigger firm shares. Overseas markets, notably rising markets, may be extra unstable than U.S. markets as a result of elevated political, regulatory, social or financial uncertainties. Fastened Revenue investments have publicity to credit score, rate of interest, market, and inflation danger. Diversification doesn’t guarantee a revenue or assure towards a loss.

The MSCI ACWI Index is designed to symbolize efficiency of the total alternative set of large- and mid-cap shares throughout 23 developed and 24 rising markets. The ICE BofA US Broad Market Index tracks the efficiency of US greenback denominated funding grade debt publicly issued within the US home market, together with US Treasury, quasi-government, company, securitized and collateralized securities.

For Funding Skilled use with shoppers, not for unbiased distribution.

Please contact your BCM Regional Advisor for extra info or to handle any questions that you could have.

Beaumont Capital Administration LLC

125 Newbury St. 4th Ground, Boston, MA 02116 (844-401-7699)

Read more on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.